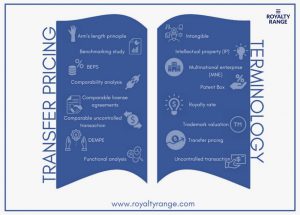

TRANSFER PRICING TERMINOLOGY EXPLAINED

The RoyaltyRange team has put together a glossary of key terms that you will likely come across when using our royalty rates and service fees databases to access third-party intellectual property (IP) and service fee data for a range of purposes. If you require further assistance, simply contact us today.

The main source for the following definitions is the Organisation for Economic Co-operation and Development (OECD)’s 2017 Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations, which is the most recent consolidated version of the Guidelines.

Arm’s length principle:

In transfer pricing for tax purposes, the arm’s length principle states that the cost of a transaction between related company entities must be the same as if it had occurred between independent parties. The OECD calls it the “international standard that OECD member countries have agreed should be used for determining transfer prices.”

Benchmarking study:

This is an in-depth overview of comparable license agreements and royalty rates that taxpayers can use to assess whether their transfer pricing complies with the arm’s length principle. You can order a RoyaltyRange benchmarking study here.

BEPS:

The abbreviation BEPS signifies the OECD’s base erosion and profit shifting initiative, which is a multilateral framework to reduce the tax evasive movement of profits to low- or no-tax jurisdictions.

Comparability analysis:

The OECD defines a comparability analysis as a “comparison of a controlled transaction with an uncontrolled transaction or transactions.” It is used for the selection of a transfer pricing method, as well as determining arm’s length prices or profits.

Comparable license agreements:

These are publicly available, third-party legal contracts between two parties for the licensing of IP, which can be used by organizations to set the conditions of their IP-related transactions. Get access to license agreements database.

Comparable uncontrolled transaction:

For the purposes of identifying arm’s length pricing, the OECD defines a comparable uncontrolled transaction as “a transaction between two independent parties that is comparable to the controlled transaction under examination.”

Controlled transaction:

This is a transaction that takes place between two related company entities – e.g. the French and German divisions of a business – and for which arm’s length transfer pricing must be established.

DEMPE:

The abbreviation DEMPE refers to the development, enhancement, maintenance, protection and exploitation of intangibles. You can find a more in-depth explanation with great practical examples in our blog post about DEMPE.

Functional analysis:

Organizations should conduct a functional analysis to establish arm’s length transfer pricing. This will provide a structural overview of the organization and the entities within it, and identify the functions performed, risks assumed and assets used by each of these entities and how they affect the context within which the taxpayer operates. You can find more information about the role of the functional analysis in section 1.51 of the OECD’s final Actions 8–10 report.

Intangible:

An intangible is essentially a company asset that is not physical or financial in nature. You can read a more in-depth RoyaltyRange blog about intangibles.

Intellectual property (IP):

An organization’s IP refers to intangible assets that it has invented, created or acquired, such as know-how, technology and brand names. IP can be legally protected by patents, copyright and trademarks.

Multinational enterprise (MNE):

This is a company within an MNE group (an MNE group is “a group of associated companies with business establishments in two or more countries”).

Patent Box:

This is a corporation tax scheme that offers organizations a reduced rate of tax on profits from its patented inventions. You can find out more about this topic in our article about Patent Box.

Royalty rate:

When the legal owner of an intangible licenses it out to another party for commercial use, that party must pay a royalty. Royalty rate – is a percentage of the income that the party generated through the use of the intangible. You can find out more about this in our article about Royalty rates.

Trademark valuation:

As organizations can sell and license their trademarks and other IP, it is important that they understand how much it is worth before they do so. Valuation of trademarks and other types of IP is also used for many other purposes, including transfer pricing and tax compliance. Accurate valuation of intangibles like trademarks can be achieved through RoyaltyRange’s database.

Transfer pricing:

To put it simply, transfer pricing is the amount of money that changes hands when a transaction takes place between related company entities. Find out more by reading our in-depth blog on transfer pricing.

Uncontrolled transaction:

The opposite of a controlled transaction, an uncontrolled transaction occurs between two parties that are fully independent of each other.

We hope you find this glossary of key transfer pricing terms helpful as you use our premium-quality royalty rates and service fees databases. For more information, contact us at RoyaltyRange today.

You can use these texts with reference to www.royaltyrange.com website.