Patent Box in Europe

The Patent Box (sometimes referred to as IP Box or Innovation Box) provides incentives for companies to perform research and development (R&D) activities in the country. This special tax regime gives companies a reduced rate of tax on their profits from patents and similar intellectual property or allows exempting for tax purposes the income arising out of the qualifying intellectual property.

Many developed countries introduced patent box regimes aimed at providing incentives for local research and development activities, increasing the level of patenting and commercialization in the country, retaining highly qualified professionals and avoiding tax base erosion through intellectual property transfers to low tax jurisdictions. Moreover, several countries have recently adopted amendments to further align their patent box regimes with the OECD/G20 BEPS initiatives.

To file a patent box application (or APA) and successfully get a formal approval from the local authorities, the company needs to support its application with the extensive and reliable comparable data. Data quality and comparability is key in any patent box analysis and RoyaltyRange data enables you to get the best results out of your patent box application.

RoyaltyRange provides premier quality data and services to industry leading multinational enterprises, global consulting companies, international law firms, government authorities and universities. The RoyaltyRange data is fully compliant, very valuable and productive in any patent box regime application due to the following:

- Specifically compiled for the CUP method application

- Includes detailed functional, risk and asset analysis

- OECD BEPS compliant

- Detailed third party highest quality data

RoyaltyRange data and benchmarking studies are extensively used for the patent box application purposes. The most efficient and beneficial way to get all relevant comparable data for your patent box analysis is to subscribe for an unlimited database access. Please click the link below for more information.

Italy Patent Box

The Stability Law introduced a Patent box regime in Italy in 2015. The Patent box regime is optional, it allows businesses to benefit from lower effective tax rates on profits derived from intellectual property.

This qualifying intellectual property includes patents, know-how, other industrial information and software, covered by copyrights, models and designs that could be legally protected. Trademarks qualify for the regime only if ongoing R&D activities are required for their development and maintenance. Additionally, a possibility to consider complementary intangible assets as a single intangible asset for the purposes of the Patent box regime was introduced in 2016.

The provisions in the Patent box regime are in line with the OECD nexus approach, which is defined by Action 5 of the OECD BEPS Project. It allows a taxpayer to benefit from an IP regime only to the extent that the taxpayer itself incurred qualifying research and development (R&D) expenditures that gave rise to the IP income.

The patent box regime may provide an exemption from corporate and regional income tax. The exemption is equal to 30% for 2015, 40% for 2016 and 50% starting from 2017, and is granted for five years.

The exact calculation of the tax exemption depends on the share of profit generated by the IP. Patent box regime can only be applied for the holder of the IP rights carrying out R&D activities, which means either the owner of the IP rights or the licensee. When the patent box regime involves direct use of IP, obtaining a ruling from the Revenue Agency is mandatory in order to determine the eligible income. In the case of an indirect use of IP, the ruling is optional as the eligible income may be determined by the amount in the agreement concluded between the licensor and the licensee.

Moreover, potential capital gains realized from the sale of qualifying IP could be exempt from taxation, provided that at least 90% of the gain is reinvested in R&D activities.

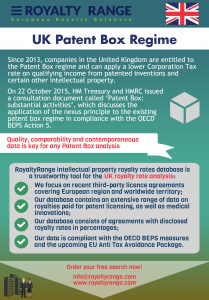

United Kingdom Patent Box

The UK patent box was introduced in the Finance Act 2012, effective from 1 April 2013. As part of the Government’s aim to encourage innovation in the UK and ensure the commercialisation of UK IP, a new 10 per cent corporation tax rate has been introduced that applies to patent box profits. This is a significant saving as compared to the standard tax rate of 20 per cent (by 2016).

A company qualifies if it owns (or licenses on exclusive terms) qualifying patents and has either created or developed the patented innovation or a product incorporating it. If another entity has carried out this development, the company must be responsible and involved in the decision-making concerning the development and exploitation of the patent.

UK Patent Box applies to patents granted by the UK Intellectual Property Office and the European Patent Office, as well as by certain states within the European Economic Area (EEA). The range of qualifying income is broad and includes royalties and income from the sale of patents that qualify for this regime and also profits from the sales of products that incorporate a patented innovation.

On 22 October 2015, HM Treasury and HMRC issued a consultation document called ‘Patent Box: substantial activities’. This consultation document discusses the application of the nexus principle to the existing patent box regime in compliance with the OECD BEPS Action 5 ’Countering harmful tax practices more effectively, taking into account transparency and substance’. The UK welcomes the work done by OECD to ensure that substantive economic activity is required to be undertaken as a pre-requisite for access to all preferential IP regimes, as is already required under the patent box.

The central point of a new internationally harmonised framework for preferential IP regimes (like the UK’s patent box) is that for a business to gain the benefit of a preferential regime, it should have conducted the substantial activities which generates the income benefiting from that regime. Under the nexus approach, the R&D expenditure would be used as a proxy for substantial activity and therefore would link benefits to the requirement to have undertaken the R&D expenditure incurred to develop the intellectual property.

Hungary Patent Box

As of 7 June 2016, Hungary has implemented a tax bill, amending the previous intellectual property (IP) regime to be in compliance with action 5 of the OECD’s base erosion and profit shifting (BEPS) project (“Countering Harmful Tax Practices More Effectively”). With regards to the amendment, the modified nexus approach is introduced, which shall reduce the available benefits under the IP regime.

The new regime shall apply to IP acquired after the date of 30 June 2016, although the old rules will be grandfathered until 30 June 2021 concerning IP for which an entity was qualified to receive benefits with respect to the old regime, which may provide a limited window of opportunity for companies to maintain benefits under the old regime for an additional five years.

Old regime

Under the old IP regime, royalties from IP benefited from 50% lower taxation than the already low general corporate income tax rate applicable in the country, resulting in effective tax rates of between 5 to 9.5% depending on the level of profitability. In cases of considerable expenditure associated with IP income, even lower effective tax rates could be achieved due to deductions from the general tax base calculated on gross income from IP, rather than on profits associated with IP. Additionally, the sale of IP benefited from a full tax exemption provided that a one year holding period was maintained or that the proceeds were utilised for further IP purchases.

New regime

The above tax benefits shall effectively remain in place, however, significant changes have been made to the range of qualifying IP, the approach to determining the amount of royalties and the extent of the relevant tax benefits.

Under the new IP regime, the definition of royalty will be limited to payments made concerning industry related protected IP and will no longer foster payments made with respect to trademarks, know-how or other marketing related IP nor will it cover IP protected by copyright laws other than copyrighted software. Furthermore, benefits will be calculated from IP related profits rather than from gross income. With regards to the nexus approach imposed by Action 5 of BEPS, benefits will be limited to the proportion of the taxpayer’s own R&D expenditure as opposed to acquisition costs paid for already developed IP or R&D costs incurred by other group companies.

Up-to-date data

Make sure to use only the most advanced tools and premium-quality data for your projects concerning IP. With changes to the regime, up-to-date royalty figures become a necessity. RoyaltyRange is fully compatible with the most recent OECD BEPS and EU regulations, providing you with the most relevant data for your specific needs.

You can use this text and infographics with reference to RoyaltyRange website.