Belgian Patent Box

The updated Belgian Patent Box was announced in a press release by the Belgian Ministry of Finance on December 2nd 2016. The modified law replaced the previous regime of patent income deduction in Belgium. Here we outline the main features and conditions of the law.

What is the new Belgian Patent Box regime?

The new Belgian Patent Box regime was approved by the Belgian Parliament on February 2nd 2017. It replaced the previous tax deduction for patent income with new tax deduction for innovation income, and has been extended to include small- and medium-sized enterprises (SMEs) as well as multinational enterprises (MNEs). The innovation income initiative measures apply retroactively from July 1st 2016, and will exist alongside the old scheme until June 30th 2021 (during the ‘grandfather period’). The Belgian Ministry of Finance states that the law complies with the Organisation for Economic Co-operation and Development (OECD)’s base erosion and profit shifting (BEPS) guidelines, which are designed to help global businesses ensure compliance against tax evasion and artificially placed profits.

What intellectual property (IP) is within the scope of the Belgian Patent Box regime?

The new Belgian Patent Box scheme means that taxpayers can now apply for tax deduction for income and capital gains from innovation activities as well as patents and supplementary protection certificates (SPCs). This tax deduction applies for self-developed IP rights and IP rights that have been acquired or licensed from third parties. Marketing intangibles (e.g. trademarks) are not qualifying assets. The following IP is within the scope of the initiative:

- Patents and SPCs (as per the previous Belgian Patent Box law)

- Copyright-protected software produced as part of a research and development (R&D) project

- Designations for orphan drugs (these must have been requested or acquired on or before July 1st 2016)

- Data and marketing exclusivity IP (usually for medical products)

- Plant variety rights (these must have been requested or acquired on or before July 1st 2016)

What are the main conditions of the Belgian Patent Box scheme?

Taxpayers can apply for patent deductions under the previous Belgian Patent Box scheme, while the new law comes into force. However, if taxpayers apply for patent box deductions during this grandfather period they cannot also apply for innovation deductions with the new scheme for the same IP for tax periods ending before July 1st 2021.

The new scheme differs from the old regime in many ways, including in terms of the qualifying assets. It offers a higher deduction rate (85% of the net qualifying income) than the previous scheme. This means that the effective tax rate for qualifying innovation income in Belgium could be as low as 5.1%. Deduction will be worked out by comparing the R&D costs to the total costs related to the innovation.

The new scheme also means that tax deductions are valid even if companies merge or split. If a company’s IP rights are breached, then any compensation it receives may also be eligible for the tax deduction. Further, if a company does not use a deduction, they can use it for the subsequent taxation period. It should be noted that the tax deduction does not affect any investment deduction that a company receives for the same piece of innovation research IP.

Belgian Patent Box formula

The Belgian Patent Box formula is the following: (qualifying R&D costs/total R&D costs) x total income from intellectual property = qualifying income from intellectual property

The qualifying R&D expenditure may be uplifted with 30%, with a maximum of the overall R&D expenditure.

Accessing data for the Belgian Patent Box scheme

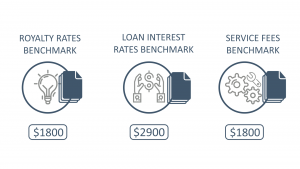

RoyaltyRange offers high-quality third-party data to companies in Belgium and around the world. Our data complies with the OECD can be used for Belgian Patent Box applications. If you would like to find out more or purchase a database subscription, contact us today.

Order RoyaltyRange benchmarking study

Our benchmarking study is a comparison of license agreements and royalty rates. It helps with the determination of an arm’s length (market) royalty rate range for specific products or services. This information is used for Patent Box applications.