BEPS AND ROYALTYRANGE

RoyaltyRange is fully compliant with the new OECD regulations:

I. Guidance on Transfer Pricing Aspects of Intangibles

II. Guidance on Transfer Pricing Documentation and Country-by-Country Reporting

On 5th October 2015, the OECD issued final reports on 15 focus areas on the approach to combat tax avoidance under the Base Erosion and Profit Shifting (BEPS) Project. One of the long-awaited and key elements of these recommendations is the Guidance on Transfer Pricing Aspects of Intangibles. Another very important deliverable by the OECD is the Guidance on Transfer Pricing Documentation and Country-by-Country Reporting. The RoyaltyRange database, and the royalty rate data it offers, is fully compatible and follows the regulations set by the OECD.

You may find the reports here:

I. Guidance on Transfer Pricing Aspects of Intangibles

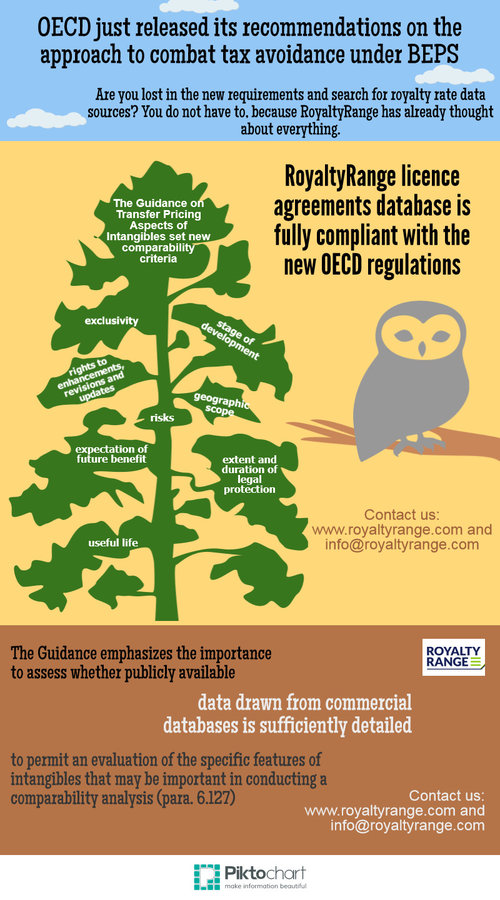

The Guidance on Transfer Pricing Aspects of Intangibles (the Guidance) sets a list of new comparability features to be taken into account when carrying out a comparability analysis in transactions involving intangibles. This is a significant development showing the importance attached by the OECD to comparability in transfer pricing analysis.

Geographic Market

The geographic market, as a very important comparability issue, is outlined at the beginning of the Guidance.

Paragraphs 1.110, 1.112, and 6.120 indicate that features of the geographic market in which business operations occur can affect comparability and arm’s length prices. Difficult issues can arise in evaluating differences between geographic markets and in determining appropriate comparability adjustments (Chapter I, D.6. Location savings and other local market features, Paragraph 1.80).

The Guidance further states that in assessing whether comparability adjustments for such local market features are required, the most reliable approach will be to refer to data regarding comparable uncontrolled transactions in that geographic market. Such transactions are carried out under the same market conditions as the controlled transaction, and, accordingly, where comparable transactions in the local market can be identified, specific adjustments for features of the local market should not be required (Chapter I, D.6.2.: Other Local Market Features, Paragraph 1.145).

The RoyaltyRange database is a specialised database containing royalty rates and licensing data for European territories and also encompassing worldwide territory.

New Comparability Factors

According to Chapter VI: Special considerations for intangibles of the Guidance, the framework for analysing transactions involving intangibles requires the following steps:

- identification of intangibles and their categories;

- identifying the legal owner of intangibles;

- identifying the parties performing functions, using assets, and assuming risks related to developing, enhancing, maintaining and protecting the intangibles by means of functional analysis;

- identification and proper characterization of the type of transaction involving intangibles.

New comparability factors of intangibles that may be important in a comparability analysis are introduced:

- Exclusivity

- Extent and duration of legal protection

- Geographic scope

- Useful life

- Stage of development

- Rights to enhancements, revisions and updates

- Expectation of future benefit

- Comparison of risk

Where limitations are imposed on the rights in intangibles transferred, identification of the nature of such limitations and the full extent of the rights transferred are considered important.

The RoyaltyRange database contains all the aforementioned royalty rate and licensing term data, which is presented in the report for each licence agreement.

Sufficiently Detailed Data

The Guidance emphasises the importance of detailed royalty rate and licensing term data when conducting a comparability analysis.

It states that comparability, and the possibility of making comparability adjustments, is especially important in considering potentially comparable intangibles and related royalty rates drawn from commercial data bases or proprietary compilations of publicly available licence or similar agreements. In particular, it is important to assess whether publicly available data drawn from commercial data bases and proprietary compilations is sufficiently detailed to permit an evaluation of the specific features of intangibles that may be important in conducting a comparability analysis (Chapter VI: Special considerations for intangibles, D. Supplemental guidance for determining arm’s length conditions in cases involving intangibles, D.2. Supplemental guidance regarding transfers of intangibles or rights in intangibles, Paragraph 6.130).

Each licence agreement report in the RoyaltyRange database already contains all these new comparability factors. This was achieved by taking into account OECD Guidance when it was in its draft form and compiling the RoyaltyRange database based on the forthcoming requirements. Our deep understanding of OECD practices and years of development have produced a tool that will benefit your projects and enable you to be compliant with ever-increasing requirements.

II. Guidance on Transfer Pricing Documentation and Country-by-Country Reporting

The Guidance on Transfer Pricing Documentation and Country-by-Country Reporting emphasises the importance of local comparables and considers it the most reliable information.

It states that the requirement to use the most reliable information will usually, but not always, require the use of local comparables over the use of regional comparables where such local comparables are reasonably available. The use of regional comparables in transfer pricing documentation prepared for countries in the same geographic region in situations where appropriate local comparables are available will not, in some cases, comport with the obligation to rely on the most reliable information. While the simplification benefits of limiting the number of comparable searches a company is required to undertake are obvious, and materiality and compliance costs are relevant factors to consider, a desire for simplifying compliance processes should not go so far as to undermine compliance with the requirement to use the most reliable available information (Chapter V, D. Compliance issues, D.9. Other issues, Paragraph 46).

The RoyaltyRange database is compliant with the Guidance on Transfer Pricing Documentation and Country-by-Country Reporting and meets the requirement for local comparables.

You can read more about EU Anti Tax Avoidance here.

You can use this text and infographics with reference to RoyaltyRange website.