Credit rating estimation tool

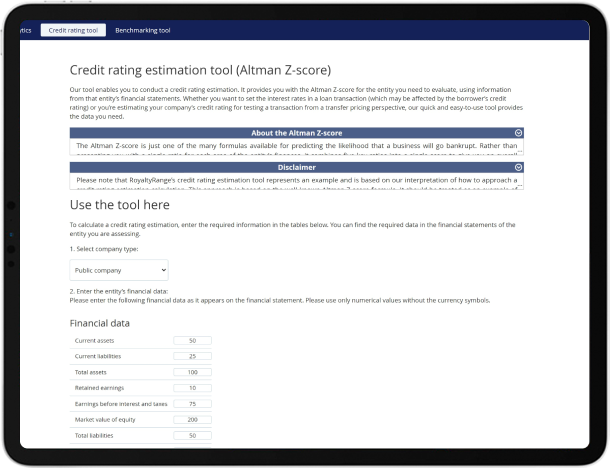

Credit rating estimation tool (Altman Z-score)

With our credit rating estimation tool, you can calculate the credit rating of a borrower in a transaction quickly and accurately, based on company financials.

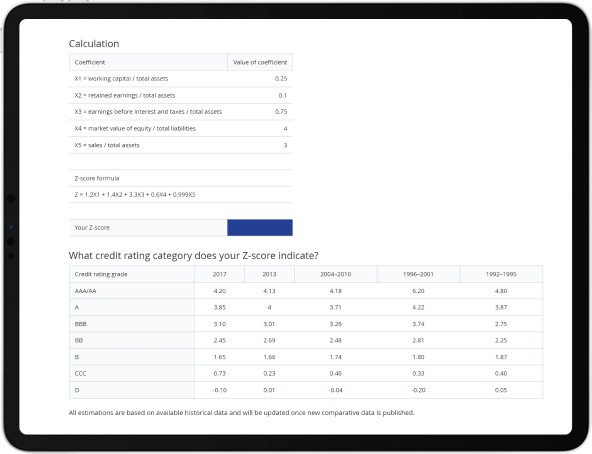

Using the tool, you can take information from the company’s financial statements, such as current assets and retained earnings, to calculate its Altman Z-score.

Whether you want to set the interest rate in a loan transaction or estimate your company’s reference credit rating, our quick and easy-to-use tool provides the data you need.

About the Altman Z-score

The Altman Z-score is just one of the many formulas available for predicting the likelihood that a business will go bankrupt. Rather than presenting you with a single ratio for each area of the entity’s finances, it combines key ratios into a single score to give you an overall indication of the entity’s financial performance. This enables you to efficiently measure the entity’s risk of bankruptcy. A score of 2.99 or higher suggests a company is safe from bankruptcy, while a score of 1.81 or under suggests they are at risk. Scores in between indicate potential issues.

Request nowWhy RoyaltyRange?

At RoyaltyRange, we provide transfer pricing data that is trusted by clients around the world, including tax authorities, international consulting companies and multinational enterprises.

With our range of databases, covering private company financials, royalty rates, service fees and loan interest rates, and tools for benchmarking, DEMPE analysis and estimating credit ratings, you can access everything you need for accurate transfer pricing, all in one place.

Join over 1,000 clients in over 70 countries in using our transfer pricing solutions.